Decoding the Buffett Indicator: Implications for Private Equity Multiples

Decoding the Buffett Indicator: Implications for Private Equity Multiples

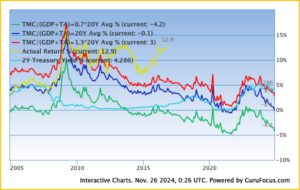

The Buffett Indicator, which compares the total U.S. stock market capitalization (TMC) to the nation’s GDP, serves as a barometer for assessing market valuation extremes. With the current ratio at 206.3%, far exceeding its 20-year average of 119.83%, concerns about elevated asset prices extend beyond public equities to private markets, including private equity (PE).

Current State of the Buffett Indicator

The Buffett Indicator’s traditional value of 206.3%, alongside its modified version (TMC divided by GDP plus Federal Reserve total assets) at 166.5%, underscores extreme valuations in the financial markets. While this metric primarily evaluates public equities, its implications ripple into private equity due to the interconnectedness of asset classes.

Why the Buffett Indicator Matters for Private Equity

Private equity valuations, measured through entry multiples (e.g., EV/EBITDA), are indirectly influenced by public market valuations. Here’s how:

- Benchmarking to Public Markets:

- Private equity deal multiples are often benchmarked against comparable public companies. When public company valuations are stretched, private multiples tend to follow, as investors are willing to pay a premium for growth potential in private deals.

- Cheap Capital and Debt Markets:

- Elevated public market valuations are often supported by loose monetary policy, which also drives down borrowing costs for private equity firms. This creates a highly competitive environment, inflating acquisition prices.

- Increased Competition for Deals:

- With public markets overvalued, investors seeking higher returns increasingly turn to private markets, driving up demand for private equity investments. This competition further inflates multiples.

Private Equity Multiples in an Overvalued Market

Historical data shows a strong correlation between high public market valuations and elevated private equity entry multiples. Current PE multiples are at record highs, often exceeding 12-15x EV/EBITDA for middle-market transactions, compared to historical norms of 7-9x.

Key reasons include:

- High Liquidity: Significant dry powder (uncalled capital commitments) in private equity funds, estimated to exceed $3.5 trillion globally, forces firms to compete for deals at higher valuations.

- Exit Expectations: Elevated public market valuations boost private equity firms’ expectations for higher exit multiples, encouraging them to pay more upfront.

Risks to Private Equity Returns

While private equity can deliver superior returns through operational improvements and leverage, high entry multiples pose significant risks:

- Compressed Returns:

- Paying more for an investment reduces the multiple expansion potential upon exit, compressing returns unless operational value creation is extraordinary.

- Macroeconomic Sensitivity:

- If public markets are correct, private equity portfolios may face write-downs, especially for companies acquired at high multiples.

- Debt Risks:

- High leverage in deals increases the vulnerability of private equity firms to rising interest rates or economic downturns.

Strategies for Private Equity Firms

- Focus on Operational Value Creation:

- Firms must shift from relying on multiple expansion to generating returns through operational improvements, cost efficiencies, and strategic growth initiatives.

- Smaller and Niche Deals:

- Targeting smaller or niche markets with less intense competition can offer more reasonable valuations.

- Exit Timing:

- High public market valuations allow private equity firms to exit their investments at premium multiples. However, careful timing is crucial to avoid market corrections.

- Sector Selection:

- Investing in sectors with resilient cash flows, such as healthcare, technology infrastructure, or essential services, can mitigate valuation risks.

Conclusion

The current Buffett Indicator levels signal heightened market valuations that extend beyond public equities into private equity. As PE firms grapple with rising entry multiples and competitive deal environments, the focus must shift to value creation and prudent risk management. While liquidity and investor demand remain strong, private equity players should prepare for potential headwinds, including a public market correction, that could compress multiples and returns.