The M&A Process

Founders and entrepreneurs can often build great businesses with incredible attention to systems and processes, excellent teams, and a fantastic product. Yet some are unaware of how a company is sold or the acquisition process. From a Buyer’s perspective, the entire process is laid out sequentially as follows:

Read MoreICE’s acquisition of Black Knight Financial Systems (one of the largest M&A deals of 2023)

One of the year’s most significant mergers and acquisitions was ICE’s purchase of Black Knight Financial. The $11.9 billion deal closed in September of 2023, making Black Knight a part of ICE. ICE is an Atlanta-based electronic exchange that trades in futures, swaps, OTC markets, stocks, FOREX, and more, as well as having a mortgage origination system and software lending tools. Black Knight, on the other hand, provides integrated technology, services, data, and analytics to the mortgage lending, servicing, and real estate industries and capital and secondary markets. The FTC initially blocked the deal in March, citing concerns about the merged company’s market share in the mortgage technology market. However, the FTC withdrew its objections after Black Knight divested two business units, and the deal was allowed to proceed.

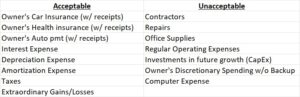

Acceptable vs. Unacceptable Add-backs

In the world of mergers and acquisitions (M&A), add-backs are a crucial factor in determining the true financial state of a target company. These adjustments to a company’s financial statements allow buyers to evaluate the real earnings or cash flow potential of the business they’re looking to acquire. However, the distinction between acceptable and unacceptable add-backs can be a contentious issue during negotiations. It’s important to understand the difference to ensure a fair and transparent transaction.

2024 Goldman Sachs M&A Outlook

2024 GS Outlook: What to Expect in M&A and Beyond

As we head into the new year, it’s important to take stock of what to expect in the coming months. According to GS analysis, large-scale M&A is expected to normalize after a slow start in 2024. But that’s not the only trend to watch.

We’ve also seen a shift toward older economy sectors such as industrials, materials, power, and natural resources. And while sponsors have been less active in M&A, more corporate buyers are participating, with a notable focus on take-private activity.

Companies are simplifying their portfolios and focusing on strategic and financial restructuring, while activist campaigns are expanding, including a focus on large-cap companies. Take-private transactions have continued at a near-record pace due to various factors, including attractive buyout offers.

But there’s good news for sponsors: activity is expected to gain momentum in 2024 as the environment stabilizes. With all these trends in mind, it’s clear that 2024 will be a year of change and opportunity. Stay tuned for more insights as the year progresses.

Read More